Best Forex Starter Kits to Buy in November 2025

Trade Like Pro. The Ultimate Trading Kit to Master Supply & Demand: Trade Like Professionals

My Trading Journal - Premium Log Book for Stock Market, Forex, Options, Crypto - Guided Trading Journal with 80 Trades, 8 Review Sections - Ideal for Day Traders, Swing Traders, Position Traders (Royal Gray)

-

ELEVATE PERFORMANCE WITH 80 GUIDED TRADE REVIEWS!

-

CUSTOMIZE YOUR TRADING SETUP FOR MAXIMUM PROFIT POTENTIAL!

-

TRACK EMOTIONS TO BOOST DECISION-MAKING SKILLS!

Sticker Day Trading | Chart Patterns Forex Transparent 3,3 x 3,1 Inch

- BULLS & BEARS AT A GLANCE: CHART CONSTELLATIONS FOR DAY TRADING!

- ATTACH UNDER KEYBOARD: QUICK ACCESS TO VITAL TRADING PATTERNS.

- EASY TO REMOVE & WASHABLE: MESS-FREE TRADING WITH NO RESIDUE!

Forex Trading Desk Mat - Large Trading Mouse Pad with Candlestick Chart Patterns - Gift for Trader and Forex Investors - Forex Trading Accessories

- COMPLETE FOREX GUIDE WITH PATTERNS & STRATEGIES FOR SUCCESS!

- BOOST EFFICIENCY: 55 EXCEL & 52 WORD SHORTCUTS INCLUDED!

- DURABLE DESIGN: PREMIUM 4MM THICK FOR LONG TRADING SESSIONS!

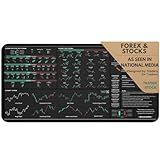

Forex & Stocks Trader's Desk Mat - Large Trading Mouse Pad with Candlestick Chart Patterns - Forex, Stock Market & Day Trading Setup - Forex Trading Accessories - Gifts for Traders & Investors

-

COMPREHENSIVE TRADING GUIDE: ESSENTIAL PATTERNS AND PAIR INSIGHTS!

-

MAXIMIZE PROFITS: KNOW MARKET TIMINGS FOR OPTIMAL TRADING SUCCESS.

-

DURABLE DESIGN: PREMIUM QUALITY ENSURES COMFORT DURING TRADING SESSIONS.

3 Pcs Life is Ups and Downs Day Trader Stock & Forex Trading Sticker Day Trader Forex Trading Chart Stock Trading Accessories Stickers Gift Laptop Bottle Phone Car Helmet Hard Hat Gifts 3" (F1 HO)

-

PERSONALIZE ANY SMOOTH SURFACE WITH EASY-TO-APPLY, RESIDUE-FREE STICKERS.

-

PERFECT GIFT CHOICE: MOTIVATIONAL, HUMOROUS STICKERS FOR ALL OCCASIONS.

-

HIGH-QUALITY, WATERPROOF STICKERS WITHSTAND EXTREME WEATHER FOR LASTING USE.

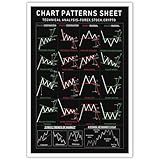

Chart Pattern Poster for Stocks, Forex, Crypto Traders - Enhance Your Trading with Aesthetic Wall Art for Home & Office Decor(12x18inch-Unframed)

-

CUSTOMIZE YOUR DECOR: CHOOSE FRAMED OR UNFRAMED OPTIONS EASILY.

-

DURABLE CANVAS: WATERPROOF, DUSTPROOF, AND EASY TO CLEAN FOR LONGEVITY.

-

PERFECT GIFT: UNIQUE ART PIECE IDEAL FOR ANY OCCASION OR LOVED ONES!

Trading Starter Kit Bundle: 2 Books in 1 - Your Complete Guide to Options and Forex Trading With Step-by-Step Instructions and Expert Strategies!

Forex trading has increasingly captivated investors worldwide due to its potential for significant profits and flexibility. As we transition into 2025, aspiring traders are eager to understand the capital requirements for entering this dynamic market. Contrary to popular belief, you don’t need a fortune to begin trading in the forex market. However, the amount you start with can greatly influence your risk management strategy, potential returns, and the kind of trading experience you have.

Initial Capital Requirements for Forex Trading

The minimum amount needed to start trading forex will depend on various factors, including your financial situation, your trading goals, and your willingness to accept risk. Here’s a breakdown of potential starting capital:

-

Micro Accounts:

- Amount: \(50 to \)500

- Opportunity: Provides a low-risk entry point for beginners who wish to test their strategies without significant financial commitment. Ideal for learning and refining trading skills.

-

Mini Accounts:

- Amount: \(500 to \)5,000

- Opportunity: Offers more leverage and allows traders to make slightly larger trades. Suitable for those who have some understanding of forex trading and want to explore further.

-

Standard Accounts:

- Amount: $5,000 and above

- Opportunity: Recommended for those who are serious about forex trading. This account type facilitates larger trades, providing the potential for higher profits – but also higher risks.

Key Considerations When Determining Initial Forex Capital

-

Risk Management: Effective risk management is essential in forex trading. Typically, it’s advised to risk no more than 1-3% of your trading capital on a single trade. Determine your risk tolerance to decide on an appropriate account size.

-

Broker Requirements: Different brokers have varying minimum deposit requirements. Research and select a stock broker with forex trading that aligns with your initial capital and trading goals.

-

Leverage: While leverage can amplify profits, it can also increase losses. Ensure that you understand how leverage works and use it wisely.

-

Education and Strategy: Equip yourself with the necessary knowledge and strategies to succeed in forex trading. Consider investing in forex trading book discounts or exploring resources on forex trading strategies in 2025 to strengthen your trading plan.

Conclusion

Starting to trade forex in 2025 doesn’t require a massive fortune, especially with the advent of micro and mini accounts that allow entry into the market with smaller capital. However, the key lies in educating yourself, practicing sound risk management, and employing effective trading strategies.

By understanding how much money you need and preparing accordingly, you’ll be in a better position to pave a successful path in the world of forex trading. Remember, it’s not the size of your initial capital that ultimately determines success, but rather the wisdom with which you use it.